This guide is designed by students, for students, as a go-to resource for the upcoming election, providing essential information to help you make informed decisions. As members of the UVU community, it's crucial that we actively engage in the democratic process and exercise our right to vote. The Herbert Institute Election Guide aims to empower students with knowledge about candidates, their platforms, and the issues impacting our community. By understanding the impact of your vote, you can shape the future of our community and beyond.

Thank you for participating in the democratic process and your commitment to civic engagement. Let's register to vote and make our voices heard!

Requirements:

register Now or Check Registration Status

Looking for how and where to vote in upcoming elections? Utah allows voters to vote by mail (or dropbox), vote early in-person at various voting locations, and in-person on election day. Click below and enter your street address for information on how and where you can vote in the upcoming elections.

General ElectionTuesday, November 5th, 2024

Other Important Dates: October 15 - General Election Ballots mailed out October 22 - In-person early voting period begins October 25 - Last day to register to vote online in the general election November 1 - In-person early voting period ends November 4 - Last day mail-in ballots can be postmarked |

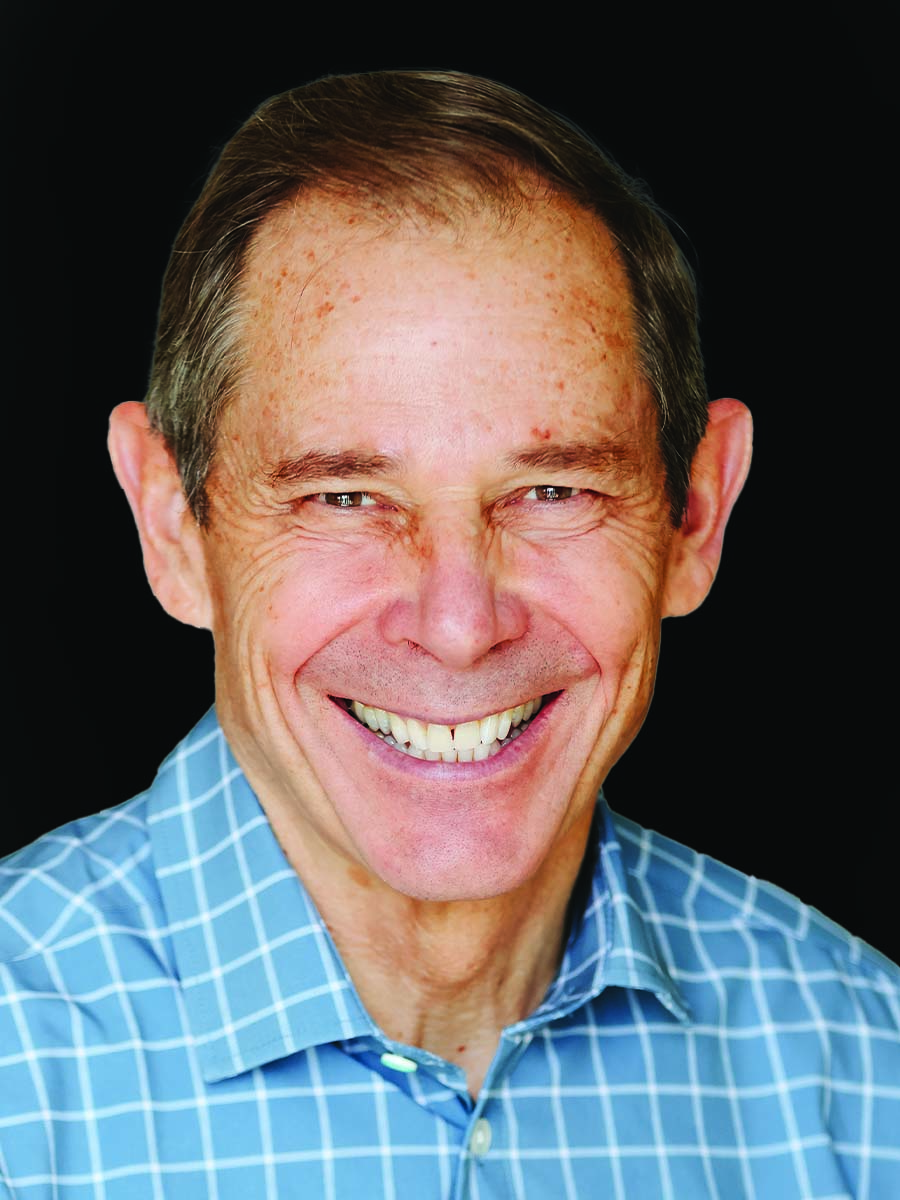

Independent American Party Convention Candidate.

Candidate will appear on the General Election Ballot in November.

Candidate's Response on:

Affordable Housing

I support a Free-Market Capitalist economy, where consumers, not government, choose the winners and losers. This economic system has proven to provide the most prosperity for the greatest number of people. It also provides the greatest quantity of housing at the lowest cost, typically exactly matching housing supply with housing demand. The current problem with housing affordability is twofold:

1. The Federal Reserve articifically increased the price of money (interest rates) thereby increasing the cost of borrowing, i.e. the monthly mortgage payment for a home. Controlling interest rates is a price control,

not free-market. A free-market interest rate would reduce boom bust cycles in our

economy.

2. The Biden administration continued Covid stimulus payments after Covid was over and the economy was already recovering. This stimulus, in the form of thousand dollar plus checks to individuals throughout the country, was one of the factors that fueled enormous inflation after that.

I support Audit the Fed and End the Fed legislation, and traditional money (Gold & Silver) solutions (see Carlton4USSenate.com)

which would help lower inflation, including housing inflation, making housing more

affordable again.

Student Loan Forgiveness/Higher Education Affordability

Student loan forgiveness is illegal, unconstitutional and unfair. It is a political

ploy to buy your student vote.

1. The Supreme Court ruled Biden's student loan forgiveness is illegal.

2. Student loan forgiveness violates Article II of the U.S. Constitution because the president doesn't have the authority to forgive student loans. The President is to enforce existing laws, which are created by congress. Congress hasn't passed a student loan forgiveness law.

3. Student loan forgiveness is unfair to other students, who may have already paid

a portion or all of their student loan debt.

4. Student loan forgiveness creates a "moral hazard" by incentivizing the non-payment of student loan debt, and possibly other debt, by future borrowers.

Student loan forgiveness should be seen for what it is: an attempt by unprincipled

politicians to get elected at any cost, even if it violates our laws, Constitution,

and basic principles of fairness. You should reject those who promote student loan

forgiveness as unfit for political office in our Constitutional Republic.

National Debt

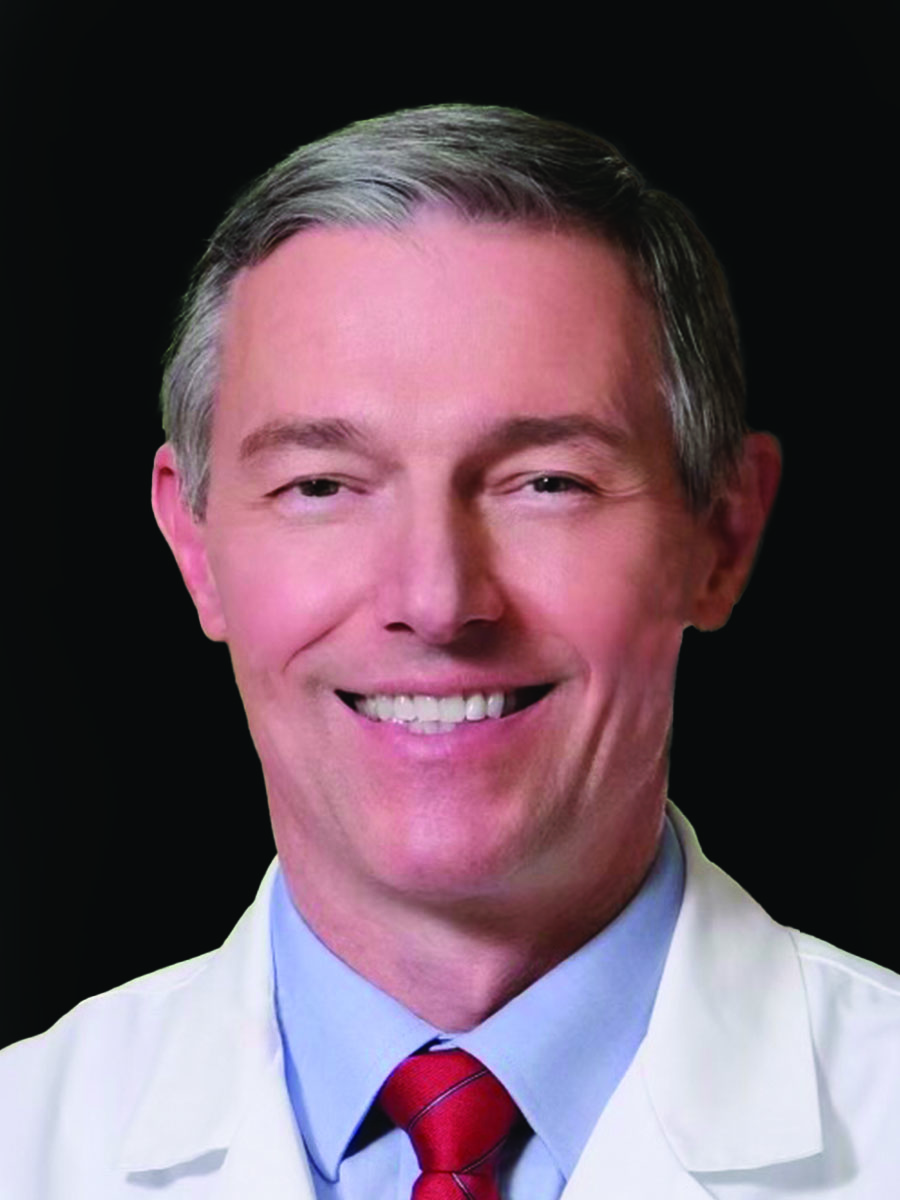

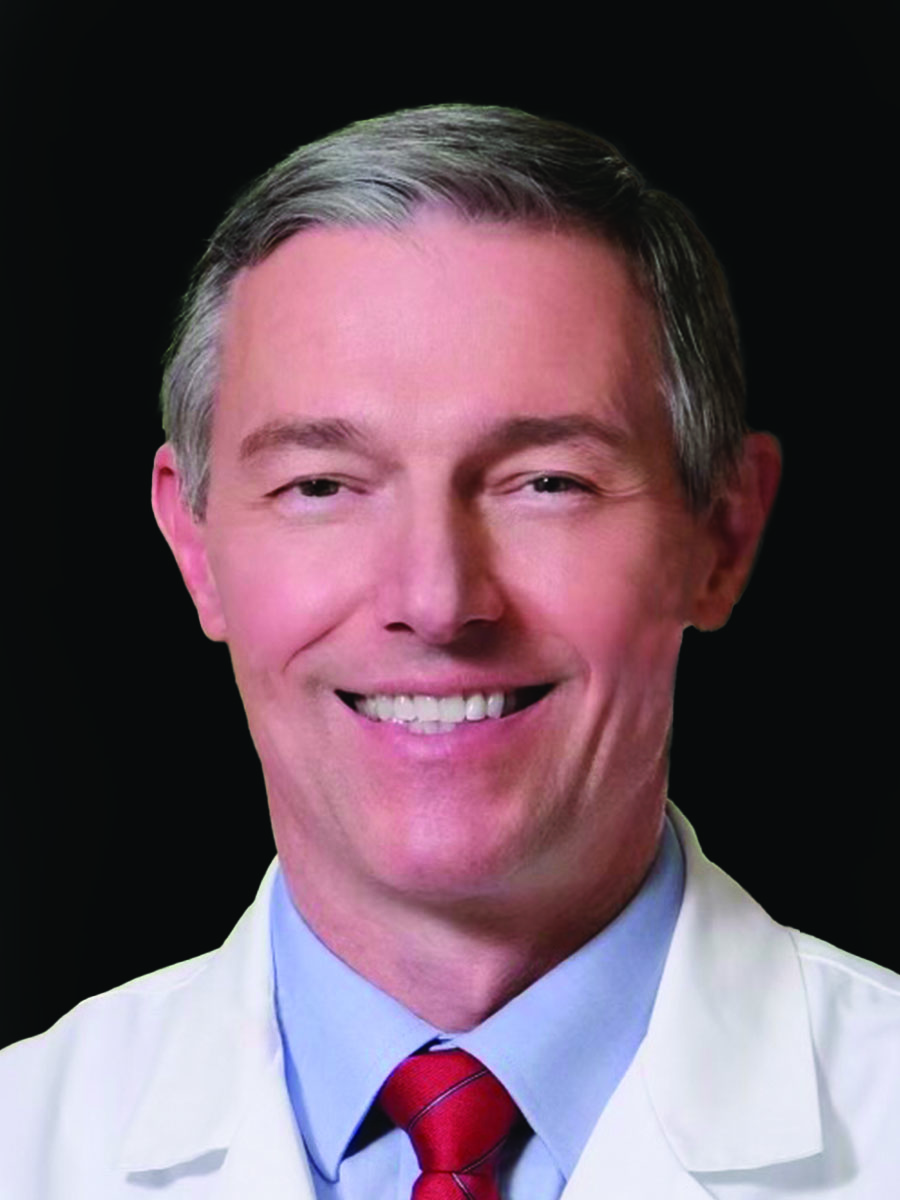

Candidate advanced in the Primary Election and will appear on the General Election Ballot in November.

Candidate is currently serving as a congressman in Utah's 3rd Congressional District.

Candidate's Response on:

Affordable Housing

Housing is more than just a necessity—it’s a critical investment in your retirement. I am proud to champion policies that allow the use of certain federal lands for responsible, affordable housing construction, as well as increasing flexibility within retirement accounts to help purchase your first home. We need to expand our housing supply and make it easier to access the funds needed to buy a home.

Student Loan Forgiveness/Higher Education Affordability

It is crucial that we keep education affordable and accessible. Unfortunately, the cost of college has skyrocketed, largely due to government subsidies that artificially inflate tuition. Instead, we need to realign incentives so that colleges receive federal funding based on their success in helping students secure jobs after graduation.

National Debt

The national debt is one of the greatest long-term threats to our country’s prosperity, and we must be honest with your generation about the unsustainability of our current path. We need to prioritize fiscal responsibility by cutting excessive government spending and balancing the budget. That’s why I have opposed every spending bill in Congress that doesn’t move us toward solving this critical issue.

Democratic Convention Candidate.

Candidate will appear on the General Election Ballot in November.

Candidate's Response on:

Affordable Housing

Did not receive a response.

Student Loan Forgiveness/Higher Education Affordability

Did not receive a response.

National Debt

Did not receive a response

Candidate voted out in GOP Convention on April 27, 2024.

Running uncontested as the Democratic candidate for Utah's 1st Congressional District.

Candidate will appear on the General Election Ballot in November.

Candidate's Response on:

Affordable Housing

Did not receive a response.

Student Loan Forgiveness/Higher Education Affordability

Did not receive a response.

National Debt

Did not receive a response

Election Candidate.

Candidate will appear on the General Election Ballot in November.

Candidate's Response on:

Affordable Housing

Did not receive a response.

Student Loan Forgiveness/Higher Education Affordability

Did not receive a response.

National Debt

Did not receive a response

GOP Convention Candidate.

Candidate will appear on the General Election Ballot in November.

Candidate is currently serving in this position.

Candidate's Response on:

Affordable Housing

Did not receive a response.

Student Loan Forgiveness/Higher Education Affordability

Did not receive a response.

National Debt

Did not receive a response

Election Candidate.

Candidate will appear on the General Election Ballot in November.

Candidate's Response on:

Affordable Housing

Affordable housing is a problem for everyone. Inflation has made it difficult. I think each state needs to have a plan that is customizable to that State's individual situation. This is not a one size fits all situation and the States would have a better idea of how to address it at their level.

Student Loan Forgiveness/Higher Education Affordability

As a Non-Traditional student myself, I would love for Higher Education to be more affordable. Unfortunately, Universities are private Institutions and can charge what they choose. Higher Education is a choice and not a requirement. You can make it more affordable through scholarships or working to be able to afford the school of your choice.

I don’t believe in Student Loan Forgiveness. If you choose to take out a loan for highereducation or anything else for that matter. You are agreeing to repay it. It is your responsibility to do so.

National Debt

Our current National debt is due to government overspending and inflation, also caused by the government. Moving forward the government needs to reduce spending and realize that there is no such thing as a debt ceiling. The government is living beyond the means of the citizenry. Omnibus bills for the budget need to stop and every department needs to justify their budget.

GOP Convention Candidate.

Candidate advanced from the Primary Election on June 25, 2024.

Candidate will appear on the General Election Ballot in November.

Candidate is currently serving in this position.

Candidate's Response on:

Affordable Housing

Did not receive a response.

Student Loan Forgiveness/Higher Education Affordability

Did not receive a response.

National Debt

Did not receive a response

Candidate will appear on the General Election Ballot in November.

Candidate's Response on:

Affordable Housing

Did not receive a response.

Student Loan Forgiveness/Higher Education Affordability

Did not receive a response.

National Debt

Did not receive a response

Democratic Convention Candidate.

Candidate will appear on the General Election Ballot in November.

Candidate's Response on:

Affordable Housing

Did not receive a response.

Student Loan Forgiveness/Higher Education Affordability

Did not receive a response.

National Debt

Did not receive a response

GOP Convention Candidate.

Candidate advanced from the Primary Election on June 25, 2024.

Candidate will appear on the General Election Ballot in November.

Candidate's Response on:

Affordable Housing

Did not receive a response.

Student Loan Forgiveness/Higher Education Affordability

Did not receive a response.

National Debt

Did not receive a response

Running uncontested as the Democratic candidate for Utah's 3rd Congressional District.

Candidate will appear on the General Election Ballot in November.

Candidate's Response on:

Affordable Housing

Housing affordability is not just a challenge; it's a pressing issue for young people and students today. Many of you are graduating college with student loans and lower incomes, making it almost impossible to afford rent or buy a home in many cities, especially in Utah.

Over the past few decades, economic policies have made it easier for the wealthy to get richer while wages for the middle and working class have stayed the same or even decreased. This has made it harder for regular people to afford housing, and builders have focused more on building expensive homes that only the wealthy can afford.

Back in the 1970s, a typical family could afford a typical home. That is no longer a fact. In places like Utah, buying a house can take three to five times the average income. For students and young people just starting out, that’s a huge obstacle. According to recent data, median home prices are more than four times higher than average household incomes in many areas.

One way to makehousing more affordable is to change zoning laws so that we can build more homes that regular people, including students and young people, can afford. Local governments should also partner with state and federal governments to get funding for affordable housing projects. If local communities can buy land and build the infrastructure—like roads and utilities—for affordable housing, it can cut the cost of homes by up to 30%.

We need leaders at every level of government who are committed to fixing the affordable housing crisis. By voting for representatives who care about this issue, you can help create the changes that will make it easier for you and future generations to afford housing. Your vote can make a real difference.

Student Loan Forgiveness/Higher Education Affordability

Over the past few decades, college costs have dramatically increased faster than everyday living expenses like rent and food. This makesit harder for many students to afford school. Students were given loans without checking if they could realistically pay them back later, trapping many in debt. Meanwhile, the companies giving out loans were promised big profits and knew students couldn’t escape the debt, even through bankruptcy. Colleges also took advantage by raising tuition prices more than necessary, making education even less affordable.

This is why we need some form of loan forgiveness—to give students a fair chance to build a future without being weighed down by debt.

Looking forward, we need to make college and trade schools cheaper, so more students can get the skills they need for good-paying jobs. In Utah, for example, tax cuts mostly helped the wealthy, but more students could afford college if some tax money had been used to lower tuition. By redirecting savings from tax cuts toward tuition reduction, we can make higher education affordable for everyone.

National Debt

"The national debt is a big issue because it affects our future—our ability to get jobs, afford education, and live comfortably. There are two main reasons for this debt. First, programs like Social Security and Medicare are running out of money because there aren’t enough workers to support all the retirees. Second, we use government services we like but aren’t paying for.

For example, the Social Security trust fund is set to run out of money by 2033, meaning a 21% cut in benefits. Currently, only the first $160,000 of people’s income is taxed for Social Security. If we remove that limit, we could extend Social Security’s life until 2046. However, the program works best when there are three workers for every retiree. That number is dropping, so we need solutions like raising taxes or allowing more immigrants to work and pay into the system.

Medicare also faces problems because healthcare in the U.S. is more expensive than anywhere else. The recent change that lets the government negotiate drug prices is a good start, but we must expand this policy to keep costs down.

Another big part of the debt problem is that we demand a lot of government services, but we don’t raise enough money to pay for them. We must raise taxes on the super-wealthy (people making $450,000/ year or more) so they pay their fair share, and we need to make sure the government spends that money wisely.

Investing in things like clean energy and infrastructure, as well as tackling climate change, will create jobs and improve our lives in the long run. That’s much better for us than giving tax cuts to the super-wealthy, who’ll invest in themselves instead of investing the money back into society."

Candidate will appear on the General Election Ballot in November.

Candidate's Response on:

Affordable Housing

I want to moderate the housing market by temporarily subsidizing material costs such as lumber, concrete, and labor. If applied, such subsidy should be publicly documented and accounted for in the final sale price of the home, or in the rent price of the property.

Student Loan Forgiveness/Higher Education Affordability

As a student with accumulated debt, I actually don't like the idea of general debt forgiveness. I am in favor of waiving interest case by case, but college education is already decreasing in value. Loans for trade school or vocational school with careers in high demand should have greater government support up to and including loan forgiveness.

National Debt

The national deficit is one of the most consequential issues we face today, and I aim to address this by minimizing the overspending Democrats and Republicans contribute to the debt. One way to address this is by shifting the tax collection from the federal government to the states' governments for a lot of pricy tax investments pursued by party politics.

Running uncontested as the United Utah candidate for Utah's 4th Congressional District.

Candidate will appear on the General Election Ballot in November.

Candidate's Response on:

Affordable Housing

Did not receive a response.

Student Loan Forgiveness/Higher Education Affordability

Did not receive a response.

National Debt

Did not receive a response

Democratic Convention Candidate.

Candidate will appear on the Primary Election Ballot in November.

Candidate's Response on:

Affordable Housing

Homeownership is a key part of the American Dream, but it's increasingly out of reach for many young people and recent graduates. To address this, we must expand affordable housing options, reduce barriers to construction, and create programs that help young people transition from renting to owning a home. This is critical not only for building generational wealth but for ensuring that our communities remain vibrant and diverse.

Student Loan Forgiveness/Higher Education Affordability

The cost of student loans has outpaced both the economy and the jobs many degrees provide, leaving graduates burdened with debt that takes decades to repay. I support efforts to make higher education more affordable, including expanding grant programs, lowering interest rates on student loans, and supporting targeted loan forgiveness for public service workers. No one should be burdened with crippling debt for seeking an education, and we must ensure that students have affordable paths to success, whether through college or vocational training.

National Debt

The national debt is a serious issue that must be addressed thoughtfully and with bipartisan cooperation. I believe we can start reducing the debt by closing tax loopholes for corporations and the wealthiest individuals who avoid paying their fair share. It's crucial to stabilize the debt without cutting essential services like Social Security and Medicare, which so many families rely on. I support taking a comprehensive approach to debt reduction that balances responsible spending with investments in education, healthcare, and infrastructure to ensure a stable financial future for all Americans.

GOP Convention Candidate.

Candidate will appear on the General Election Ballot in November.

Candidate is currently serving in this position.

Candidate's Response on:

Affordable Housing

Did not receive a response.

Student Loan Forgiveness/Higher Education Affordability

Did not receive a response.

National Debt

Did not receive a response

Candidate voted out in GOP Convention on April 27, 2024.

![]()

Candidate voted out in GOP Convention on April 27, 2024.

Candidate voted out in Democratic Convention on April 27, 2024.

Candidate elected not to respond to the Herbert Institute's request for comment on topics important to college students until after the general election.

Democratic Convention Candidate.

Candidate will appear on the General Election Ballot in November.

Candidate will appear on the General Election Ballot in November.

Candidate's Response on:

Affordable Housing

The Attorney General does not make law, so this office cannot directly make any new policies or changes. However, I strongly believe that there are laws and regulations (or a lack of laws in some areas) that are contributing to the excessive housing costs. I would try to highlight which laws are helping and which laws are hurting as Utah makes decisions on this issue, so that better decisions can be made.

Student Loan Forgiveness/Higher Education Affordability

I do not support a wholesale forgiveness of student loans. That most rewards those who were imprudent in their school decisions (taking loans for expensive schools) but hurts those that worked to pay for things. It also harms the economy and increases the national debt. I believe that school can become more affordable if we remove some of the laws that are helping to make it expensive.

National Debt

The national debt is wildly out of control, and we need to be serious about demanding that our representatives spend less. I strongly believe that we need to shine the light on government spending to highlight all of the ways it is being misused or used for non-governmental items, and then we need to insist that our representatives return to a place where they only spend the money required to perform their essential duties.

Running uncontested as the United Utah candidate for Attorney General.

Candidate will appear on the General Election Ballot in November.

Candidate's Response on:

Affordable Housing

The attorney general is responsible for law enforcement - not legislation or policy making. However, if property owners or landlords are colluding on price, restrictive contract provisions, or other monopolistic behavior, then there is opportunity for the attorney general to protect Utahns. Also, if discrimination is taking place, the attorney general can also ensure individual liberties are being protected. Housing affordability is a huge concern in Utah. We can't let limited supply allow those who control that supply to ignore the laws and regulations that protect our rights.

Student Loan Forgiveness/Higher Education Affordability

Again, the attorney general is responsible for law enforcement and not legislation or policy making. As attorney general, I would ensure our laws are being enforced while protecting individual liberties. Personally, I believe our state institutions have a responsibility to serve its citizens and not entrap them into a life of debt and limited choices. I support complete transparency in the loan process and greater affordability from our state institutions.

National Debt

The current national debt is a transfer of wealth from our younger generations to our older ones, and a lack of responsibility from our older generations to our younger ones. We've spent our childrens' birthrights and now want to blame them for their inability to fund essentials that have somehow become luxuries. Relating to the AG's office, we have to stop spending tens of millions of dollars on D.C. lawyers for cases that will go nowhere, especially when our county prosecutors can't even prosecute minor drug cases. We need someone willing to say no.

Candidate voted out in Democratic Convention on April 27, 2024.

Election Candidate.

Candidate will appear on the General Election Ballot in November.

Candidate's Response on:

Affordable Housing

The Libertas Institute-championed “Free to Build” initiative could increase Utah’s housing stock by eliminating state/local government barriers – such as minimum lot sizes and setback requirements – to truly attainable housing for consumers, like cottage court homes.

SB 240 passed in 2023 by the Utah Legislature, which authorizes taxpayer-funded $20,000 down payments for new home purchases, fails to provide a net benefit to housing consumers under an Austrian school of economics analysis and should be repealed. This “developer corporate welfare” artificially props up housing prices under the pretext of improving housing affordability.

Student Loan Forgiveness/Higher Education Affordability

Libertarian presidential candidate Chase Oliver proposes that, if elected, he will:

*”immediately end the Federal backing of student loans by asking Congress to make all current loans interest-free, while simultaneously ending all future government-guaranteed loans;

*”make the discharge of interest revenue neutral by requiring the Department of Defense to cut costs by closing overseas bases andinstallations and bringing our troops home, instead of engaging in expensive nation-building and peacekeeping missions abroad. It is only right that the DoD bear part of the cost, as mounting debt is as big a threat to our security as any foreign enemy, and

*”allow students to stabilize their financial situations by allowing student loan debt to be dischargeable in bankruptcy just like any other loan. I want a well-educated populace thatcan compete with the minds of any other nation, but not at the cost of our nation’s financial and retirement security.”

National Debt

It is immoral for politically-powerful, older generations with an “in the long run we are all dead” and “die broke” ethos to lavish government-provided services on themselves by incurring $35 trillion in debt — and counting — that may be borne by younger and unborn generations. I recommend A Generation of Sociopaths: How the Baby Boomers Betrayed America, by Bruce Cannon Gibney for further insights on the problem and someproposed solutions. The Libertarian Party platform supports “the passage of a ‘Balanced Budget Amendment’ to the U.S. Constitution, provided that the budget is balanced exclusively by cutting expenditures, and not by raising taxes,” and a proposed change to that platform would support “repudiating all government debts at all levels as a means of both relieving unjust financial burdens and limiting the growth of government.”